Section 110 Tax Deduction

A the company must be resident in ireland.

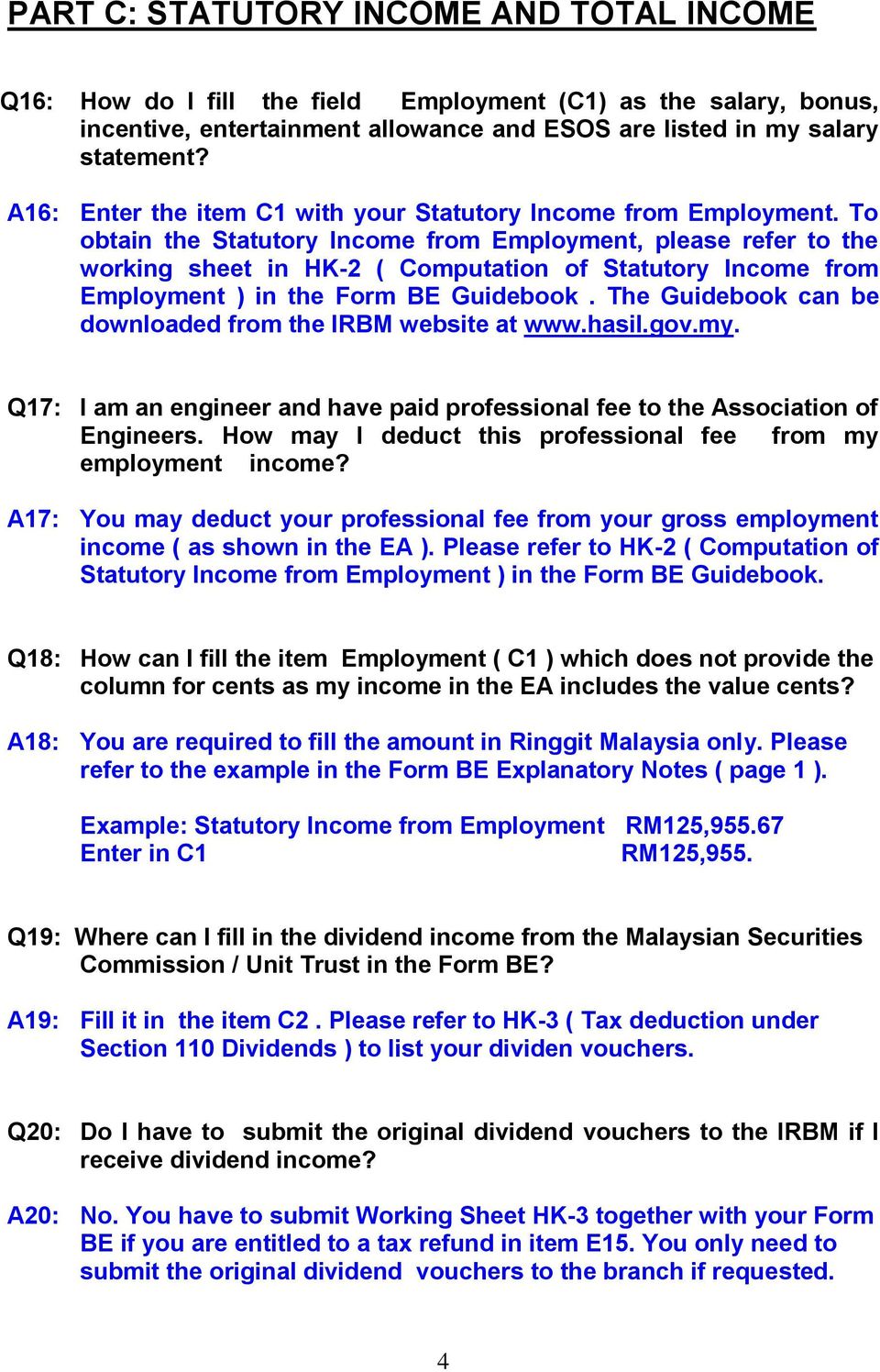

Section 110 tax deduction. Section 110 is at the heart of ireland s structured finance regime. Guidance on the amendment to section 110 by finance act 2011 was published in tax briefing 2 of 2012. I working sheet hk 3 enclosed in respect of the claim for tax deduction under section 51 of finance act 2007 dividends. A misstep under sec.

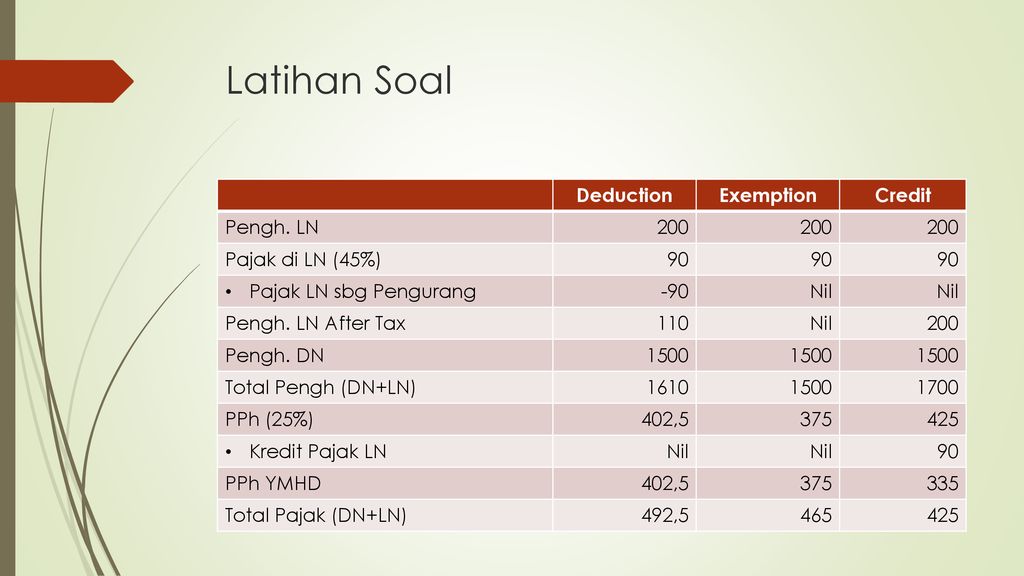

Code name of payer gross tax deducted date of receipt trust body income rm rm sen payment no. And iii hk 8 hk 9 if applicable relating to the foreign tax deducted in the country of origin. That guidance continues to be of relevance up to 1 june 2018. Ii hk 6 pertaining to the claim for section 110 tax deduction others.

17 for the purpose of clause 110 6 2 a iii a amounts deducted under this section in computing an individual s taxable income for a taxation year that ended before 1990 shall be deemed to have first been deducted in respect of amounts that were included in computing the individual s income under this part for the year because of. However proceed with caution. Year of assessment z 1 10 9 8 7 6 5 4 3 2 tot al b. A qualifying person agreed to sell or issue to the employee shares of its capital stock or the capital stock of another corporation that it does not deal with at arm s length or agree to sell or issue units of a mutual.

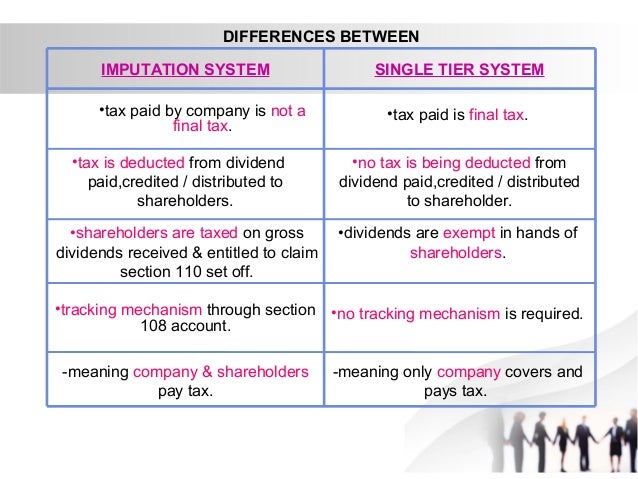

This regime which has been in existence since 1991 is widely used and internationally regarded. Tax deduction under section 110 others no. The business of a section 110 company is essentially the issue of debt and revenue are prepared to accept that costs associated with issuing debt by a section 110 company can be deducted for tax purposes irrespective of the term of the debt. Total tax deducted under section 110 others c.

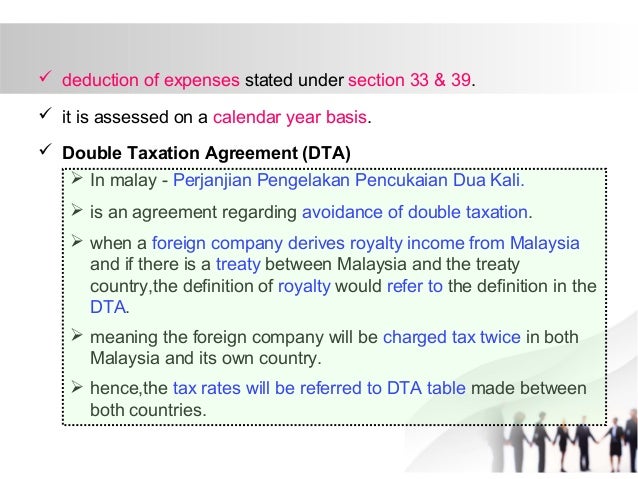

Section 110 was created in 1997 to help international financial services centre. Total gross interest income income code 3 d. Total gross royalty income income code 5. Set off under section 110 51.

Provided that that person shall not be entitled to any set off under that. Security options deduction paragraph 110 1 d the employee can claim a deduction under paragraph 110 1 d of the income tax act if all of the following conditions are met. It allows for organisations to achieve a neutral tax position provided certain conditions are met. 1 section 110 of the principal act prior to the amendment of that section under this act shall apply to a person other than an offshore company excluding chargeable offshore company in respect of any tax deducted under this part.

3 2 tier 1 debt in banks or other financial institutions. One way to plan for the tax treatment of tenant allowances is to use the qualified lessee construction allowance safe harbor provided by sec. The spv pays no irish taxes vat or duties.