Form P Partnership Malaysia

The precedent partner is responsible for filling out the form p and issuing the form cp30 to each and every partner.

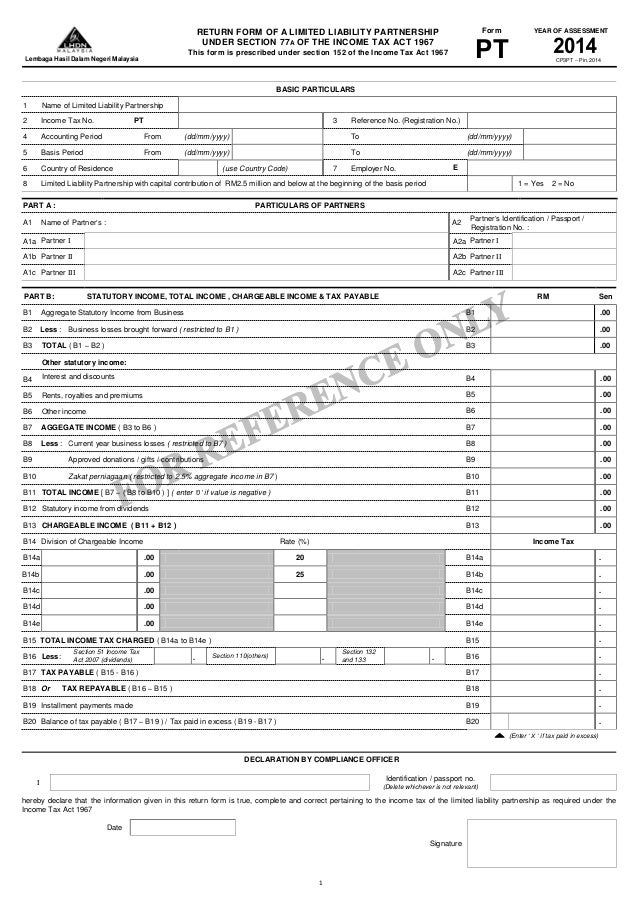

Form p partnership malaysia. Every partner has to report his share of partnership income in his form b. The following are the common forms of business organization in malaysia by an individual operating as sole proprietor. By two or more persons in limited liability partnership or. 6lpso orj lq wr p 7d ludv jry vj iru rxu exvlqhvv wd pdwwhuv xvlqj rus3dvv lwk hiihfw iurp 6hs rus3dvv frusrudwh gljlwdo lghqwlw iru exvlqhvv zloo eh wkh rqo phwkrg iru rqolqh exvlqhvv wudqvdfwlrqv zlwk wkh ryhuqphqw i rx kdyh qrw uhjlvwhuhg.

Lhdnm has to be notified in writing in case of any amendment to the form p already submitted. The form cp30 has to be provided to each partner so as to enable them to declare their partnership income within the stipulated period. This business entity structure is the best choice for an experienced entrepreneur in malaysia. Lhdnm has to be notified in writing in case of any amendment to the form p already submitted.

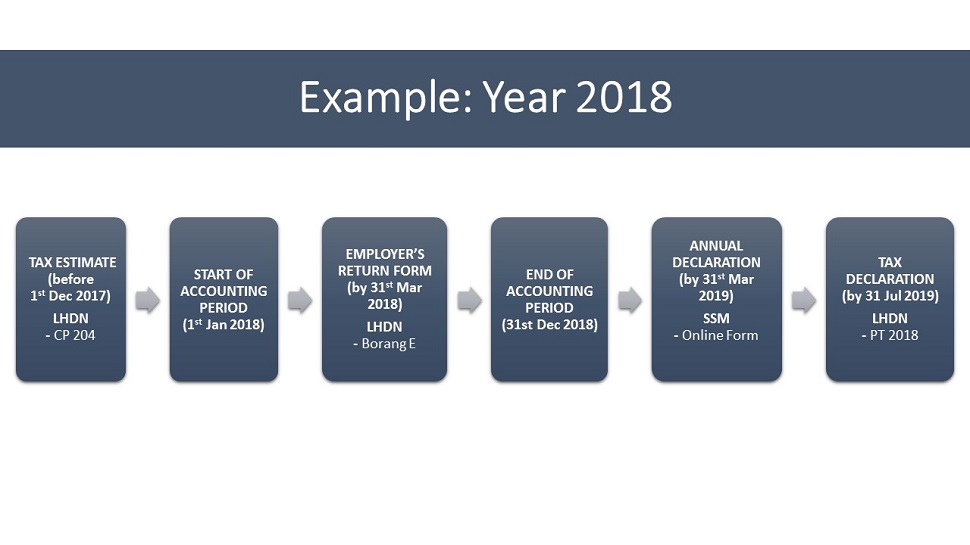

While a partnership does not pay tax it still has to file an annual income tax return called the form p to show all income earned and business expenses deducted by the partnership during the year. Sdn bhd companies in malaysia. The form cp30 has to be provided to each partner so as to enable them to declare their partnership income within the stipulated period. With this pre filling initiative the precedent partner need not separately inform the respective partners of their share of the partnership income and the individual partners can enjoy the convenience of having.

The precedent partner is responsible for filling out the form p and issuing the form cp30 to each and every partner. Cp30 shows distribution of income profit loss to each partner. The partnership could file form p through paper form submission or e filling. If a partnership e files the form p by 29 feb the partnership allocation will be pre filled in the respective partners form b b1.

Sole proprietor vs llp vs general partnership vs company in malaysia types of business entities. A sdn bhd company is a business entity with limited liability. The precedent partner is responsible for filling out the form p and issuing the form cp30 to each and every partner. Partnership owners also generally find it somewhat difficult to receive important bank loans.

Sdn bhd companies also have certain unique benefits. The deadline for filing form p is 30 june. A partnership in malaysia is a type of business which requires at least two partners and up to 20 which should be registered with the ssm by following the above mentioned rules the registration of a local business can be completed at any of the ssm offices but investors also have the option of registering it using an online portal the ezbiz online services. Additional information on partnership the precedent partner is responsible for filling up form p and issuing form cp30 to each and every partner cp30 form.