Fixed Asset Depreciation Rate In Malaysia 2017

While annual allowance is a flat rate given every year based on the original cost of the asset.

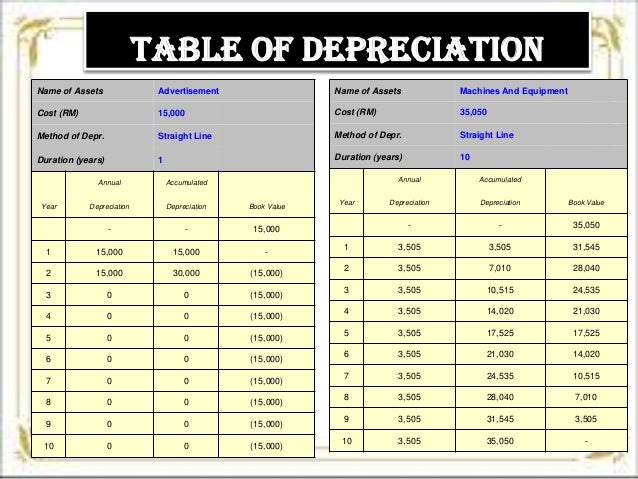

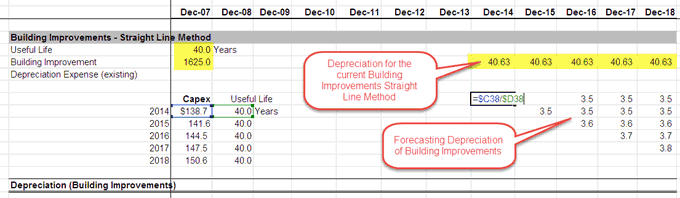

Fixed asset depreciation rate in malaysia 2017. As an example if the asset cost rm10 000 00 and the depreciation rate is 20 we would depreciate the asset rm2 000 00 each financial year over a period of 5 years. Although the straight line method of depreciation writing assets off at a fixed per year on the original cost price and the book value method of depreciation writing assets off at a fixed based on the latest book value of the assets in the balance sheet are popular methods of depreciation there are other methods also available. Accounting treatment for these assets including depreciation are prescribed by this standard. Depreciation is the systematic allocation of the depreciable amount of an asset over its useful life.

Capital allowances consist of an initial allowance and annual allowance. Motor cars 5 years straight line method 20 other. Mpsas 17 property plant and equipment 1. The depreciable amount of an asset is the cost of an asset or other amount substituted for cost less its residual value.

During the computation of gains and profits from profession or business taxpayers are allowed to claim depreciation on assets that were acquired and used in their profession or business. An entity using the cost model for investment property in accordance with mpsas 16. The income tax act 1962 has made it mandatory to calculate depreciation. 2 1 assets that qualify for tax depreciation specific fact patterns may determine different depreciation rates.

The useful lives and depreciation rates indicated below are a general indicator. 1 schedule ii 2 see section 123 useful lives to compute depreciation. Best bet most relevant search result site page pdf document. Capitalised and amortised according to the rates set out in point b above.

Depreciation under companies act 2013. Assets arising from tax amnesty program indonesia has rolled out tax amnesty program from 1 july 2016 to 31 march 2017 and any newly declared assets under this program cannot be depreciated or amortised for tax purposes. Initial allowance is fixed at the rate of 20 based on the original cost of the asset at the time when the capital expenditure is incurred. 8 worldwide capital and fixed assets guide 2017 asset type useful life for tax type of tax depreciation method applicable tax depreciation rate comments transport other than motor cars 5 years straight line method 20 other methods and rates could be used if supported by technical reasons.

Government of malaysia malaysian public sector accounting standards mpsas 17 property plant and equipment march 2013. The acquisition costs of these assets are based. The depreciation expense for each year would therefore be the same.